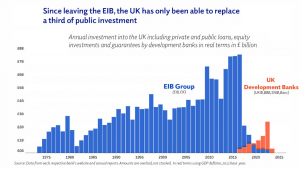

Brexit has brought uncertainty and transformation to the UK economy. Challenges include currency fluctuations, reduced investments post-Brexit (60% less than the European Investment Bank), and a significant economic impact. There is a pressing need for comprehensive policies to attract investments and stimulate economic growth. The government’s inadequate commitment to the industrial sector raises concerns about competitiveness. Rebuilding lost investments post-Brexit is a lengthy and challenging journey, highlighting the urgency of practical solutions for a prosperous future.

Consequences of Brexit

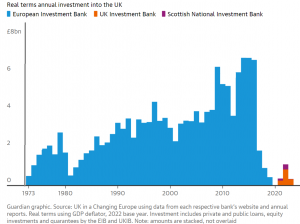

For nearly 50 years, the European Investment Bank (EIB) has been a key player in the UK’s economic development since its establishment in 1958. With a focus on EU member states, the EIB invested over a trillion euros in projects supporting sustainable growth, SMEs, and infrastructure. The EIB’s AAA credit rating enabled low-interest loans, facilitating projects deemed too risky by private investors. Brexit’s notable impact on the UK includes losing access to EU funds ending over four decades of significant EIB financing for crucial projects, from the Channel Tunnel to renewable energy initiatives. Between 2009 and 2016, the EIB invested substantially in the UK, averaging £6.4 billion. Since Brexit’s official date on January 31, 2020, the UK has faced economic and financial challenges, notably affecting currency fluctuations and exchange rates.

Here are some of the critical consequences:

Reduced Investment

According to a recent report, the EIB invested a substantial amount of £6.4 billion in the UK between 2009 and 2016. In contrast, the investment mechanisms established by the British government after Brexit only managed to invest £2.4 billion in the country. This represents just one-third of the investments made by the EIB, resulting in a significant reduction in investments in the UK post-Brexit.

The most striking revelation from the report is that only a fraction of the EU investment in the UK has been recouped since Brexit. While the EIB played a pivotal role in financing projects that contributed to the UK’s economic growth and development, the new investment mechanisms still need to fill the void left by the EIB’s departure.

The consequences of this shortfall are multifaceted

Impact on Economic Growth: The reduced investment in the UK has the potential to impede economic growth. Projects that relied on EIB funding may need more support in securing alternative financing sources, impacting sectors such as infrastructure, transportation, and renewable energy.

Political and Economic Challenges: The lousy performance of the Conservative ruling party in attracting investment, coupled with the government’s failure to invest in the industrial sector, has left the country grappling with economic consequences.

Long-lasting Effects: The lasting effects of Brexit on the UK economy are becoming increasingly apparent. The inability to match the EIB’s level of investment underscores the challenges of extricating the UK from its EU ties while safeguarding economic stability.

The Struggle to Fill the Investment Gap

The challenge of filling the investment gap left by the EIB is multifaceted. The new UK domestic development banks created post-Brexit need more staff and expertise to scale up their operations quickly. Moreover, they have yet to achieve the coveted AAA credit rating of the EIB, resulting in higher lending rates for public-interest projects. Consequently, funding projects with a public interest focus has become more expensive.

Furthermore, these newly established institutions focus less on infrastructure projects than the EIB. In 2022, they invested just 17% as much in infrastructure projects as the EIB did in its heyday.

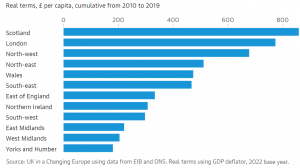

The UK Infrastructure Bank (UKIB), inaugurated two years ago, was heralded by Rishi Sunak, then the Chancellor, as a critical instrument in advancing the government’s “levelling up” agenda. However, recent assessments suggest that tangible progress toward this objective has yet to be made, as many UKIB projects have a broad national or multi-regional scope.

Political Responses to the Investment Gap

The investment gap has not gone unnoticed by British politicians. Labour’s shadow City minister, Tulip Siddiq, criticized the Conservative government’s failure to invest in British industry, which has led to economic stagnation and crumbling public services. Labour’s proposed solution involves unlocking billions of private sector investments to revitalize the economy with new gigafactories, clean steel plants, and renewable-ready ports.

The Liberal Democrat Treasury spokesperson, Sarah Olney MP, echoed these concerns, highlighting the broken promises of the Conservative government in addressing the investment shortfall.

The UK Infrastructure Bank’s Response

UKIB’s chief executive, John Flint, has indicated that the institution plans to accelerate investment in the coming years, particularly in projects aligned with the government’s net-zero ambitions. The government views UKIB as vital in addressing the investment gap and advancing its environmental objectives.

However, the UK in a Changing Europe report argues that UKIB’s growth will be limited by strict Treasury lending limits to safeguard taxpayers’ money. These public sector lenders aim to leverage governments’ lower borrowing costs and longer time horizons to attract private funding. However, due to their smaller scale, the new institutions have backed fewer, smaller, and lower-risk projects, limiting their ability to “crowd in” private funding effectively.

A Call for Comprehensive Economic Policies

Brexit has marked the dawn of a new era for the United Kingdom, reshaping its economic landscape and altering investment dynamics. The significant decline in investment levels following Brexit highlights the pressing need for comprehensive policies to attract investments and spur economic growth. As the nation grapples with the enduring effects of Brexit, addressing these hurdles becomes imperative for securing a prosperous future. The shortcomings of the conservative ruling party in creating an investment-friendly environment raise questions about the impact of the government’s economic policies on the nation’s growth prospects. The government’s need for more commitment to investing in the industrial sector has far-reaching consequences for the country’s manufacturing capabilities and ability to compete globally. The alleviation of the adverse effects of Brexit disheartens British citizens and even politicians.