Evidence shows that Britain is declining in the world. Over these days Britain has faced lots of great problems. Indeed, Britain has faced the worst economic situation these days and these economic problems have happened as a result of different fluctuations in this country.

These days the UK Economic Crisis has become the most important problem in this country. Every day this problem is increasing and it has terrible effects on different parts.

Over the past few days, the UK Economic Crisis has caused great pressure in this country. However, Liz Truss promised to improve the economy of the UK after her premiership started last month, but she couldn’t do anything useful.

Generally, the UK is not in a good economic situation and its economy is in a disastrous situation these days. It can be said that Britain’s economy is paralyzing quickly.

This year inflation has increased more than before, Ukraine Russia war, and stricter monetary policies are other factors that have increased the cost of living crisis and inflation in Britain.

So because of all these events after 30 years Britain’s economy is experiencing the worst economic situation and after 30 years this is the first time that Britain has faced this challenge.

Another reason for the economic crisis in the UK is that the Bank of England has increased its interest rate and there is no doubt that this rate of bank interest increment has had a direct effect on the economy of Britain.

Now the UK is like a house where one room-the GDP room is too cold and another room is too hot. But the radiations in the rooms have no individual controls, and there is just one thermostat. That’s the current situation of the economy of Britain.

In fact, there were lots of reasons that, had affected the UK Economic Crisis. The Ukraine war, Covid 19, and Brexit were the reasons that hit the economy of the UK.

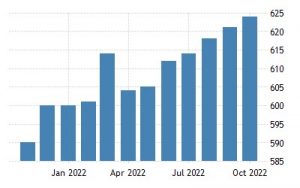

Average weekly earnings in Great Britain

From April to June the payment hasn’t had significant growth. However, the price of everything has grown, and the average wage increment in public sectors has been 1.8%.

From 2021 the UK average wage growth has been 6.8%. Indeed, the average salary in the UK is £27,756.

The average wage for people who have full-time jobs is £33,000, and people with part-time jobs receive £12,247.

In fact, people who work in marketing, advertising, and sales receive the highest payment. The average wage for these jobs is £ 74,224.

And CEO’s analyzers receive the highest rate of salary which is £72,621 in 2022, which was £97,467 in 2019. At the end of 2022, the average wage rate increment in the UK was 5.7%.

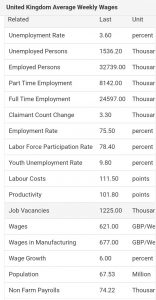

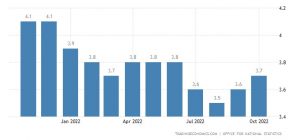

UK unemployment rate.

In fact, the rate of unemployment in the UK in 2022 is higher than the previous years. The current unemployment rate is higher than 3.6% now

There are lots of reasons for unemployment and one of them is the remedy duration of illnesses who were in the hospital.

Indeed, the current rate of lack of economic activity has increased to 21.6%. There is a great lack of occupation which is about 52000. This reduction is two times more that the market’s anticipation.

| Release Date | Time | Actual | Forecast | Previous | |

| Dec 13, 2022 (Oct) | 02:00 | 3.7% | 3.7% | 3.6% | |

| Nov 15, 2022 (Sep) | 02:00 | 3.6% | 3.5% | 3.5% | |

| Oct 11, 2022 (Aug) | 01:00 | 3.5% | 3.6% | 3.6% | |

| Sep 13, 2022 (Jul) | 01:00 | 3.6% | 3.8% | 3.8% | |

| Aug 16, 2022 (Jun) | 01:00 | 3.8% | 3.8% | 3.8% | |

| Jul 19, 2022 (May) | 01:00 | 3.8% | 3.9% | 3.8% |

Statistics show that the unemployment rate is higher than 3.6% in October, November, and December, but as compared with 1974 it hasn’t had a significant increment and the number of jobless people is at its lowest level.

However, there aren’t too many job vacancies in the UK, and lots of people are working in different parts of this country, they are not satisfied with their salaries and there isn’t an appropriate balance between their salaries and wages with the inflation.

There are lots of reasons that have caused inflation and one of the most important ones is energy price increment.

The energy price increment has had a direct effect on the increment of the prices of everything. people are suffering from the cost of living crisis in the UK and energy price increment is going to enter more pressure on the cost of living crisis.

In fact, the Ukraine war can be an important reason for the energy price increment in the UK. The house holds’ annual energy bills have risen from £1,971 ($2,380) to £ 4,427 in April, which is a significant rate.

The energy price increment is making British people poorer and poorer as a result of 13% inflation rate increment.

The UK’s current economic situation

indeed, Britain suffered from a terrible political fluctuation that was the biggest hit to this country. Not only was it harmful to the government, but also it was the worst hit to the economy of this country too.

Last week the bank of England warned that England is going to enter its longest financial recession time. this financial recession will make a 2.1 percent gross domestic product. (GPD)

statistics show that inflation in October will raise to 13 percent. According to the predictions of the Bank of England, this rate of recession will increase more and more up to 2025.

The price of energy will increase more and more and it is not clear how people are going to face the cold weather in the winter.

Indeed, the price of energy is going to increase more than 70 percent in October and the financial situation of this country is not clear again.

Even though the Pound is reducing its main value in the global markets as a result of this reduction pound won’t be useful as a usual currency in Britain anymore.

Also, Brexit and Covid were two important factors that hit the economy of Britain. These two problems were two important crises that created an intolerable financial situation in Britain.

In this critical situation, graduate students who want to enter the work market see a lack of jobs in their society and they get disappointed with their future. After a long time studying they expect to find a good job and have financial security but when they enter the work market they understand that there is no housing, no insurance, not enough salary, and even not enough healthcare services.

According to the predictions of the bank of England families’ salaries will reduce by up to 3.7 percent and this rate of reduction will be the worst hit to low-income families.

The UK economy had a significant recession in the third quarter of 2022. This recession was 0.2% which was a great rate.

Last week, the central bank of England said that England has experienced the longest recession.

The services, production, and construction industries’ rates have slowed. After the production slowed down that 13 other different sectors faced a great recession and the production slowdown had a direct effect on the activity of these 13 sectors.

Last week the bank of England anticipated the highest rate of recession over these days and said that this rate of recession will increase up to 2024.

So this recession will cause unemployment and lots of people will face unemployment. Indeed, Unemployment will reduce to 6.5 % over the next two years.

The country faces an unexpected cost of living crisis, energy crisis, and other matters that are effective in the UK economic recession.

[1] tradingeconomics.com

[2] tradingeconomics.com

[3] investing.com

[4] tradingeconomics.com